Determining the hourly wage from an annual salary can be an essential step for those wishing to better understand their earnings and budget accordingly. Converting an annual salary of $60,000 into an hourly wage can vary depending on factors such as the number of hours worked per week, the number of weeks worked per year, and whether or not an individual has paid vacation time or holidays. It is important to consider these aspects when making such calculations.

In the case of a standard 40-hour work week over 50 weeks per year, a $60,000 annual salary would translate to an hourly wage of around $30.00. This figure may be useful for comparing job offers and managing one’s finances effectively. However, the hourly wage can change depending on specific hours worked, vacation time, etc.

Given the various scenarios for calculating an hourly wage, it’s crucial to be aware of one’s work schedule and to consider these nuances when determining the true hourly value of a $60,000 yearly salary. This information can help individuals grasp their overall earnings potential and make well-informed financial decisions.

An annual salary is the total amount of money an employee earns in a year for their work. In this case, we will discuss the implications and breakdown of a $60,000 annual salary. This figure is often used as a benchmark for a decent living wage in many parts of the world.

To understand this salary more clearly, it is helpful to break it down into smaller units. One common method is to convert it into an hourly wage. Calculating an hourly wage depends on the number of hours worked. Assuming a typical full-time work schedule of 40 hours per week for 52 weeks, a $60,000 salary converts to an hourly rate of $28.85.

It is essential to consider that an hourly rate can vary depending on factors such as paid vacation time, sick days, and overtime. The federal government’s work year of 2,087 hours provides a slightly different hourly wage of $28.75 for a $60,000 annual salary. However, this specific conversion may not apply to every employee and serves as a general approximation.

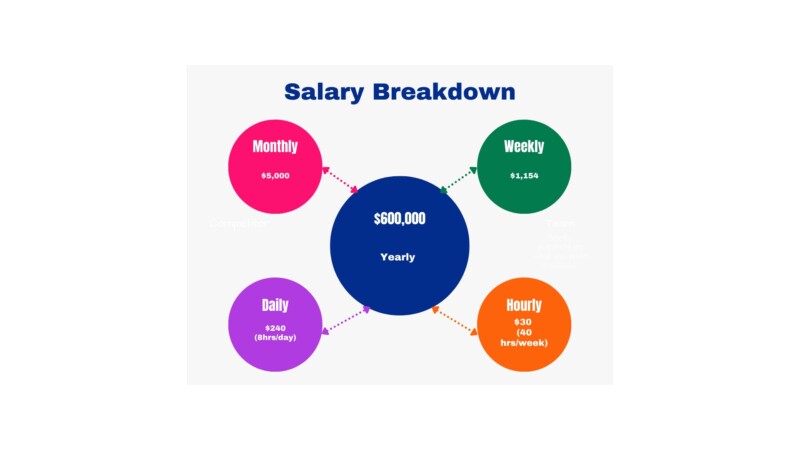

Another useful breakdown is monthly and weekly earnings. A $60,000 salary translates to $5,000 per month and $1,154 per week, which can provide a clearer perspective on financial planning and budgeting. Once again, these figures are based on a standard work year and may vary depending on the employee’s unique circumstances.

In summary, breaking down an annual salary into hourly, weekly, and monthly amounts helps to provide a clearer understanding of one’s earnings. In the case of a $60,000 annual salary, the hourly rate is approximately $28.85, with monthly and weekly earnings of $5,000 and $1,154, respectively. These conversions offer a better perspective on managing finances and evaluating one’s overall income.

See Related: How to Increase Your Salary: Get Yourself a Raise

When you have an annual salary of $60,000, you might want to know your equivalent hourly wage. It is important to compare your earnings with different job opportunities or contracts on an hourly basis. There are various tools, such as salary to hourly calculators, available online to help you with this conversion process.

To convert your annual salary to an hourly wage, you need to calculate the number of hours you work per week and the number of weeks you work per year. Most commonly, people work 40 hours a week and have paid vacations, making the total number of working days and weeks per year 50. By using these estimates, you can easily calculate your hourly rate.

Here’s a simple calculation to convert an annual salary of $60,000 to an hourly wage:

So, an annual salary of $60,000 would be approximately $30 per hour.

If you want to use a calculator or examine different scenarios for hours worked per year, breaks, or weeks per year, many such tools are available online. These tools allow you to enter your annual salary, working hours, and weeks per year and will provide you with your hourly wage more precisely.

To sum it up, converting your annual salary to an hourly wage helps compare job opportunities and analyze your income better. With a few simple calculations or an online calculator, you can determine your wage per hour and better understand your earnings structure.

See Related: How to Have Multiple Streams of Income

When someone earns $60,000 per year, how much an hour is? It is essential to understand not only their hourly wage but also their monthly and weekly earnings. To calculate these amounts, we will use a standard 40-hour workweek and 52 weeks in a year.

Monthly Wage: To determine the year’s hourly monthly wage, divide the annual salary by 12 months. In this case, $60,000 divided by 12 equals $5,000 per month.

Weekly Pay: To calculate weekly pay, determine the total number of hours worked in a year. With a 40-hour workweek, there are 2,000 hours in a year (40 hours/week x 52 weeks). Next, divide the annual salary ($60,000) by the total number of work hours (2,000). The result is $30 per hour. Finally, multiply the hourly wage by the number of hours worked in a week. In this case, $30/hour x 40 hours equals $1,200 per week.

To summarize these calculations, here is a quick breakdown:

These figures provide a clearer picture of an individual’s monthly and weekly earnings when they make a yearly salary of $60,000. Using this information, one can better understand their financial standing and make more informed decisions about budgeting, saving, and spending.

| Work hours per week | Work weeks per year | Annual Salary | Hourly Wage |

|---|---|---|---|

| 40 | 52 | $60,000 | $28.85 |

| 35 | 52 | $60,000 | $33.01 |

See Related: 400k a Year Lifestyle: Key Insights on Achieving Financial Success

When considering a $60,000 annual salary, it is essential to factor in the influence of taxes to calculate the true hourly wage. Taxes can significantly impact an individual’s take-home pay, especially when considering federal and state income taxes.

Federal income tax plays a significant role in determining the amount an individual will receive after taxes. For a $60,000 annual salary, the federal tax amounts to approximately $9,048, reducing the taxable income to $50,952. Consequently, the hourly rate becomes roughly $24.49, assuming a 40-hour work week for 52 weeks.

It’s important to remember that the federal income tax operates under a progressive system with different marginal tax rate brackets, so the rates will vary depending on the income level.

State income tax is another factor that affects earnings. State income tax rates vary from state to state, with some states imposing higher rates than others. Moreover, some states do not charge any income tax, while others follow a progressive or flat tax rate system. The combination of federal and state income taxes can considerably alter an individual’s net income.

To demonstrate the impact of taxes on an individual’s net salary, consider the following breakdown for a $60,000 annual salary:

Description Amount Annual salary $60,000 Federal income tax -$9,048 State income tax (varies) -Varies Net income (after taxes) Varies

In conclusion, when evaluating an individual’s actual hourly wage, it is necessary to account for taxes. Considering both federal and state income taxes will provide a clearer understanding of the amount an employee will truly earn, allowing for better financial planning and decision-making.

See Related: Passive Income Apps: Top Choices for Effortless Earnings

A $60,000 annual salary translates to an hourly wage of approximately $28.85, considering a 40-hour work week across 52 weeks. To provide a better understanding of how this salary compares to others, it is essential to explore median pay, variations in pay due to location, and industry standards.

According to the Bureau of Labor Statistics (BLS), the median annual wage for all workers in the United States was $41,950 as of May 2020. Making $60,000 a year places an individual’s salary above the median pay, signifying that this income is above average. It is important to note that individual industries and job positions will have varying median wages and salaries, so a more detailed comparison would be necessary to evaluate the standing within a specific occupation.

Regarding regional differences, living costs in certain areas impact salary expectations. In areas with a higher cost of living, a $60,000 annual income may be more common, while in areas with a lower cost of living, this salary could be considered more substantial.

Additionally, it helps to compare the $60,000 yearly income with the lowest income brackets and how it fairs against the minimum wage. For instance, a full-time worker earning the 2023 minimum wage of $30.77 per hour would make around $60,020 annually.

See Related: Work from Anywhere: A Guide to Remote Employment Success

The standard hours of work for a full-time job are typically considered to be 40 hours per week. At this rate, with a $60,000 annual salary, an employee would be earning approximately $28.85 per hour. This calculation assumes that the individual works for 52 weeks a year with no unpaid vacation time.

While the work hours for a full-time job are generally 40 hours per week, employees who work over 40 hours may be eligible for overtime pay. Depending on the specific job agreement and the applicable labor laws, overtime pay rates may vary. Usually, overtime pay is calculated at one full eight-hour work day and a half times the standard hourly rate for any additional hours worked over 40 per week.

In some situations, the hours of work may deviate from the traditional 40-hour workweek. This may impact the calculation of the hourly wage. For instance, if an employee who makes $60,000 a year works only 35 hours a week, their hourly wage would increase. Conversely, someone working 45 hours per week for the same salary would see their hourly wage decrease.

It is important to keep in mind that these calculations are a general guideline for understanding the relationship between annual salaries and hourly wages. Individual circumstances, job agreements, and additional factors can significantly impact an employee’s hours of work and potential overtime pay.

See Related: 7 Streams of Income: Unlock Financial Stability and Growth Today

While $60,000 per year translates to different hourly rates depending on the number of hours worked, there are additional factors that can affect the overall compensation package. One such factor is the industry-specific wages that often include benefits such as paid vacation, holidays, health insurance, and 401(k). These benefits differ across industries and may not be reflected in the hourly wage calculation.

For example, jobs in the healthcare industry typically provide a comprehensive health insurance package, while jobs in the technology sector may offer more generous 401(k) matching programs. These benefits can significantly increase the total value of an employee’s compensation package, even though they may not directly affect the calculated hourly wage.

Another important factor to consider is the geographical variations in wages and benefits. Wages and benefits often vary depending on the cost of living and local labor market conditions. For instance, a job paying $60,000 per year in a high-cost urban area may have a different value than the same job paying $60,000 in a lower-cost rural area.

In addition to the variations in base wages, local deductions and benefits can differ as well. For example, mandatory payroll deductions such as federal taxes such as state income tax, social security, and Medicare will vary across states. Additionally, employee benefits like paid vacation time and health insurance coverage may be more generous in certain locations compared to others.

Overall, the actual value of a $60,000 per year salary can be significantly impacted by industry-specific wages and geographical variations. Understanding these factors is crucial for job seekers when evaluating job offers and for employers when designing competitive compensation packages.

See Related: How to Use Money to Make Money

If you earn $60,000 per year and work 40 hours per week for 52 weeks, you would make approximately $28.85 per hour.

To calculate the monthly income for someone making $60,000 annually, simply divide the annual salary by 12 months. The monthly income would be $5,000.

A $60,000 salary on a paid biweekly basis can be calculated by dividing the annual salary by 26 pay periods in a year. This equates to approximately $2,308.00 per pay period.

To find the weekly earnings for a single person with a $60,000 per year salary, divide the annual salary by 52 weeks. The result is approximately $1,154.00 per week.

The amount of a $60,000 income after taxes will depend on individual factors such as filing status, any deductions or credits, and the state’s tax rates. It’s recommended to consult with a tax professional or use an online tax calculator for a more accurate estimate.

A $60,000 per year salary is above the median household income of most people in the United States and is considered a good salary by many. However, the perception of a good salary is subjective and can depend on factors such as location, cost of living, and personal financial goals.

Related Resources:

Last updated: September 21, 2023