Have you ever received an email from an insurance company claiming you were hired as a customer representative? Chances are American Income Life Insurance contacted you.

If you’re reading this, you likely want to do some research to decide whether you should join AIL. That’s a good move – it’s best to analyze something first and then join if it’s a good fit.

That’s one way to dodge scams and make a living working online. Is American Income Life an MLM? Without taking much time, let’s dive right in.

American Income Life is an insurance company based in Indianapolis, Indiana, and its headquarters in Waco, Texas. They also have an MLM side of things, through which they recruit individuals to promote products on their behalf.

They are similar to Primerica (another insurance company we reviewed), except their compensation plan is not disclosed to the public. To our surprise, we found no traces of it anywhere online. Screams scam, doesn’t it?

In fact, they regularly send out emails to people and use the deception that they got hired, which is not true. You only get to work with them as an individual contractor, not an employee.

That means you only get paid for bringing in referrals and not for anything else. That’s one reason a ‘price’ is attached to the job, unlike 9-5 day jobs.

The job onboarding process, however, makes it look legitimate. There’s an interview, and it seems like you’re getting hired. Instead, you’re recruited as a contractor who receives 100% commissions on your recruited people’s contributions. There is no salary involved, for sure.

AIL managers will even push you into recruiting others under you, as it also indirectly benefits them because of the MLM structure. They have training for recruiting alone.

Also read: Recommended Tools For Your Online Business

Are you thinking about becoming a contractor? Before you jump into the exciting world of sales, you need to know something.

You’ll only make money as a contractor by recruiting others to join the company and selling insurance. If you’re a born salesperson, this could be your perfect gig!

But here’s the thing: some companies’ training programs can be deceiving. They might promise you that you’ll be able to make a lot of money from residual income by promoting the system.

The truth is very few people succeed. Only 0.2% of people make it to the top!

These companies often make big promises and excite the idea of making six figures. It can be tempting, but be careful!

Once you invest your hard-earned money to become a contractor, it might be too late to realize it’s not worth it. If you do research, you’ll find many negative reviews about American Income Life Insurance.

See Related: Legendary Marketer Review

Founded in 1951, the American Income Life Insurance Company (AIL) has been a reliable provider of financial protection to individuals and families for over six decades. A subsidiary of National Income Life Insurance Company (NILICO), they offer an array of life insurance policies, including whole life, term life, final expense, and supplemental health options such as accident insurance.

Going beyond that are critical illness products designed to cover medical costs incurred during severe illnesses – all tailored to meet each customer’s unique needs! Here are some of the insurance products and features of AIL:

Whole Life Insurance Policies are an ideal choice if you’re searching for lifelong protection and a way to build wealth. You pay higher premiums than with term life insurance policies, but the coverage lasts your whole life as long as you make payments.

Plus, there’s a cash component that grows tax-deferred over time! Your beneficiary will receive the death benefit on passing away but won’t gain access to this additional savings fund. How about investing in lasting peace of mind?

Term Life Insurance Policies are the perfect way to get affordable protection for you and your loved ones. This type of policy allows people to choose a specific term period (typically between 10-30 years) in which they will receive life insurance coverage.

Their beneficiaries can use the Death Benefit payout if death occurs within that time. These policies don’t build up any cash value component as part of them, so premiums tend to remain low. Therefore, it is an ideal choice for those on tighter budgets or with shorter-term financial obligations that must be covered.

Term Life Insurance provides vital peace of mind at great prices by tailoring the length of your coverage and the amount of money available should something happen.

AIL’s final expense insurance policies provide greater peace of mind for families facing the end of life. These cost-effective and straightforward policies make it easier to plan.

It offers coverage designed to cover funeral costs without requiring extensive qualification requirements. Their coverage amounts are lower than many other forms of life insurance, making it easier to qualify.

It gives families peace of mind knowing you have handled your arrangements while protecting them from added stress at this difficult time. Plus, payments are directly issued to funeral homes after death, which offers total convenience and assurance during such sorrowful moments.

Protecting yourself from the financial shock of a serious illness doesn’t have to be daunting. AIL offers supplemental health insurance policies that provide an upfront, lump sum payment if and when you become critically ill – this money can help cover medical costs or other indispensable expenses like mortgage payments or childcare.

With critical illness coverage, families will receive peace of mind and protection if a severe illness compromises their primary income.

AIL offers its policyholders a range of free supplemental products. The Legacy Will Kit makes it easier for individuals to create wills, select a power of attorney, and appoint someone to make healthcare decisions on their behalf should they become incapacitated. The No-Cost Child Safe Kit also provides crucial information that can assist in locating a missing child.

It’s worth noting that American Income’s website only mentions the whole, term, and final expense life insurance policies. Universal, variable, indexed universal policies or add-on options such as critical illness coverage or accidental death & dismemberment protection are currently unavailable through the company.

AIL invests in its agents with comprehensive training and management practices tailored to the unique needs of life insurance. They equip each agent for success from day one – giving them a competitive edge over other life insurance companies.

See Related: Inspirational Financial Planning Quotes to Know

Having the right coverage when purchasing life insurance is paramount. That’s why American Income Life (AIL) offers personalized assistance and advice to help individuals find an option that meets their needs at a cost they can afford.

Rather than have customers guess with online quotes or pricing information on its website, AIL focuses more intently on helping you navigate your options by providing specialized guidance from experienced agents committed to finding the perfect fit for each situation.

See Related: Can You Make Money With Insurance Return Checks?

American Income Life is a trusted health and annuity insurance provider backed by the National Association of Insurance Commissioners. With operations in most states in America, AIL has made sure its offerings are accessible to as many people as possible—except New York residents.

Unfortunately, despite their commitment to quality service, awards or certifications have not yet eluded them. But this should not discredit them from being suppliers you can count on for your coverage needs!

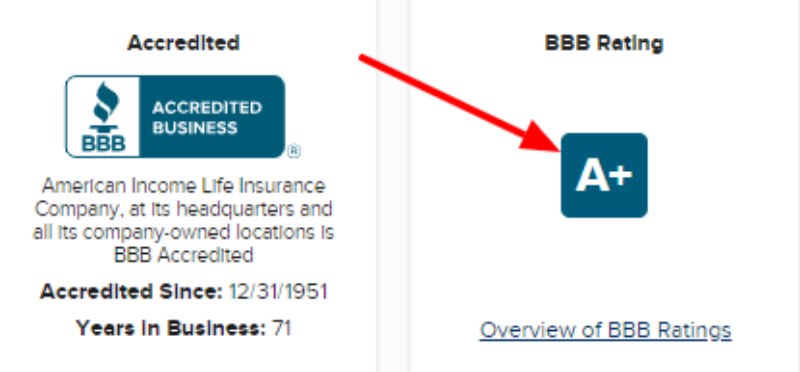

American Income Life Insurance Company takes consumer trust seriously. That’s why the company has attained accreditation from the Better Business Bureau and an impressive A+ rating! It proves they are dedicated to living up to their commitments and going above and beyond to resolve customer complaints.

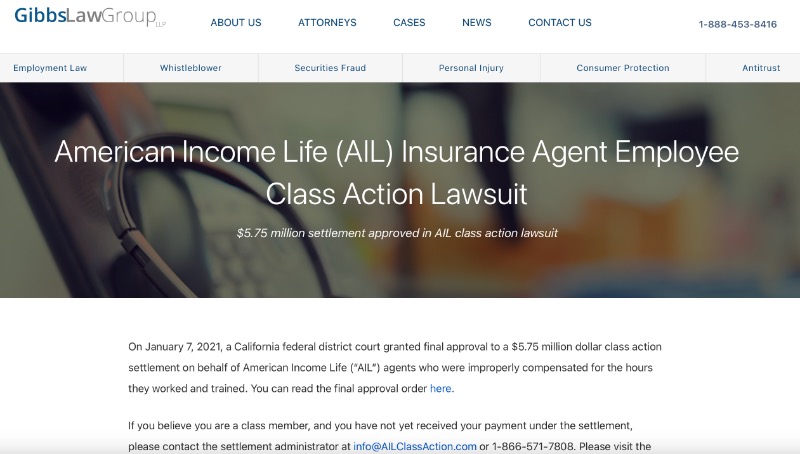

In early 2022, a consumer took American Income Life to court over allegations of fraudulently using her checking account without consent. This case sparks the beginning of a nationwide class action lawsuit. It’s seeking out any U.S.-based consumers who have had AIL initiate electronic funds transfers from their accounts in the past year and want justice for financial abuse.

Despite some legal hiccups, American Income Life has committed to providing quality insurance services. After being accused of violating California labor laws by former sales agent trainees and agents, AIL was found blameless – ultimately opting for a settlement agreement as an act of goodwill towards all involved parties. Today, they continue to serve their customers with unwavering integrity.

Established in 1951, American Income Life (AIL) has unfortunately failed to satisfy its customers. Based on the annual index report by the National Association of Insurance Commissioners, AIL’s complaint rate for 2021 was 1.64—significantly higher than typical amongst insurance companies. Some areas need significant improvement if it wants happier customer reviews!

Despite its name, AIL has had anything but an “A+” record with the Better Business Bureau. Over three years, 459 complaints have been lodged against them — 205 within the past year alone! With 519 customer reviews on their BBB page, they’ve only earned a disheartening 1.78-star rating out of five.

Sadly enough for AIL’s reputation, customers often turn to file formal grievances when dealing with dissatisfaction rather than singing praises. As such, it is not unlikely that this score reflects intolerance more than any real shortcoming in service delivery quality.

Considering the numerous customer complaints against American Income Life, potential customers must take extra precautions and research before investing in their insurance policies. Reading reviews can give you a clear picture of what kind of experience previous policyholders have had – helping you make an informed decision so that your investment is well worth it.

See Related: How to Become a Part-Time Mortgage Broker

No, AIL is not a scam, but the way they used to present things in front of very deceiving people. From the big money claims to the ‘how easy this is and all that stuff, we didn’t find any positives here.

Not everyone is good at closing sales. If you’re good at recruiting, this is the only scenario in which we recommend you check out American life insurance. Otherwise, not.

Recruiting is a choice, and it’s not everyone’s cup of tea like anything else.

See Related: Things You Should Know About Legal Shield – Is It A Scam?

Let’s face it, making money online is not easy. If it was, everyone would be working online and won’t work for their bosses anymore. Thankfully, there’s a way for the Average Joe to make money online, which is our #1 recommendation in 2019, and the business model it utilizes is affiliate marketing. We all started somewhere and were total beginners at one stage. No matter where you are and what your current skills are, if you take action on the training, you will make money.

We can’t guarantee you results, though. We don’t know whether or not you’ll check out our top recommendation for making money online or how good your work ethic is.

Click Here For Our #1 Recommendation

We have students who made money within a week of joining this training; some took a month and a few months. The faster you move, learn, and take action, the faster you’ll see results.

Just remember – The ONLY limits you have are in your head.

Related Resources

Last updated: November 27, 2024