Are you into cryptocurrencies? Do you fancy growing your Ethereum using an alternative investment platform?

Emp.money could be a good fit for you. In this review, we take a sneak peek into the platform and share everything you need to know.

Is it legitimate or a scam/Ponzi scheme? Read on to find out.

EMP crypto is sometimes referred to as cryptocurrency. EMP Money is the complete platform, with EMP being the native token of the crypto passive income ecosystem, with ESHARES.

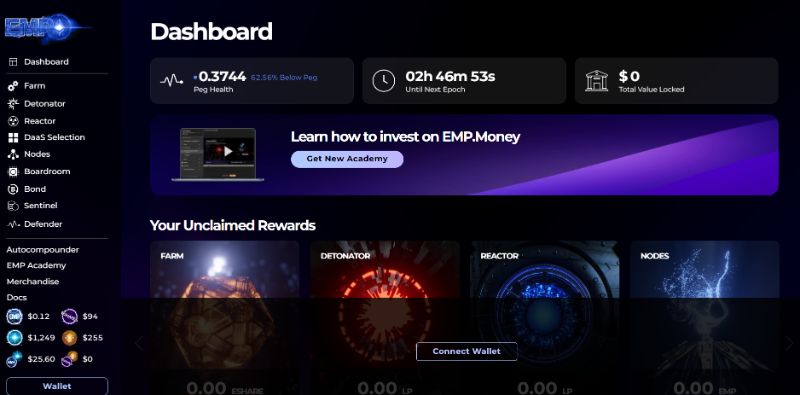

As per the website, EMP has a 4000:1 peg to Ethereum. So, depending on how you feel about Ethereum, this could be something that’s worth a shot.

If you believe in ETH long-term, you should trust the protocol’s underlying mechanisms. Moreover, this isn’t something that can tank in value overnight unless the EMP price takes a big hit. The peg can be a good or a bad thing, depending on how you look at it.

You can monitor EMP’s current price on CoinMarketCap in real-time here.

With EMP.Money, there are several entry points into the ecosystem and ways of creating wealth. It works similarly to the Tomb ecosystem but has a peg to Ethereum instead of Fantom.

Tomb Finance thrived, but when the prices of Fantom tanked, Tomb followed.

EMP takes the best bits from Tomb and makes things even better by using Ethereum, which is way safer as it’s considered a blue-chip cryptocurrency.

There’s also a token called ESHARES that you can invest in the system’s mechanisms and deploy in the EMP team boardroom, which is somewhat riskier as it depends on the market.

EMP shares are volatile assets that can skyrocket/plummet in value in days. For these reasons alone, you’re better off without playing with it. Now comes the fun part – here’s how you can get started with EMP:

BNB, or Binance Coin, is the native token of the BEP20 ecosystem. Formerly called Binance Smart Chain, the network is now known as BNB Smart Chain.

Since it’s the native token, it’s added by default in decentralized exchanges like Pancakeswap, and you won’t have to bother adding a contract address.

Since BNB is used for paying transaction fees, you’ll need a small amount in your wallet. You can buy Binance Coin from Binance and then withdraw to your DEX wallet, like Metamask, using an appropriate network for your withdrawal.

You can either manually create an EMP-ETH LP token by going to pancakeswap farms or create one in one click using the “Zap In” feature on the website. Once successful, you’ll have an EMP-ETH liquidity pair token that you can use inside the ecosystem.

The LP token can be used to enter the three available farms – EMP-ETH, ESHARE-BNB, and EMP-ESHARE. The first pair is recommended, as EMP is pegged to Ethereum, so there shouldn’t be any impermanent loss.

The LP token is made up of two tokens, with each sharing 50% of the value. If one token increases/decreases in price, the system will automatically buy/sell more of the other token to maintain the 50-50 ratio.

It can be a deal-breaker buying more of the losing token by selling your more profitable token.

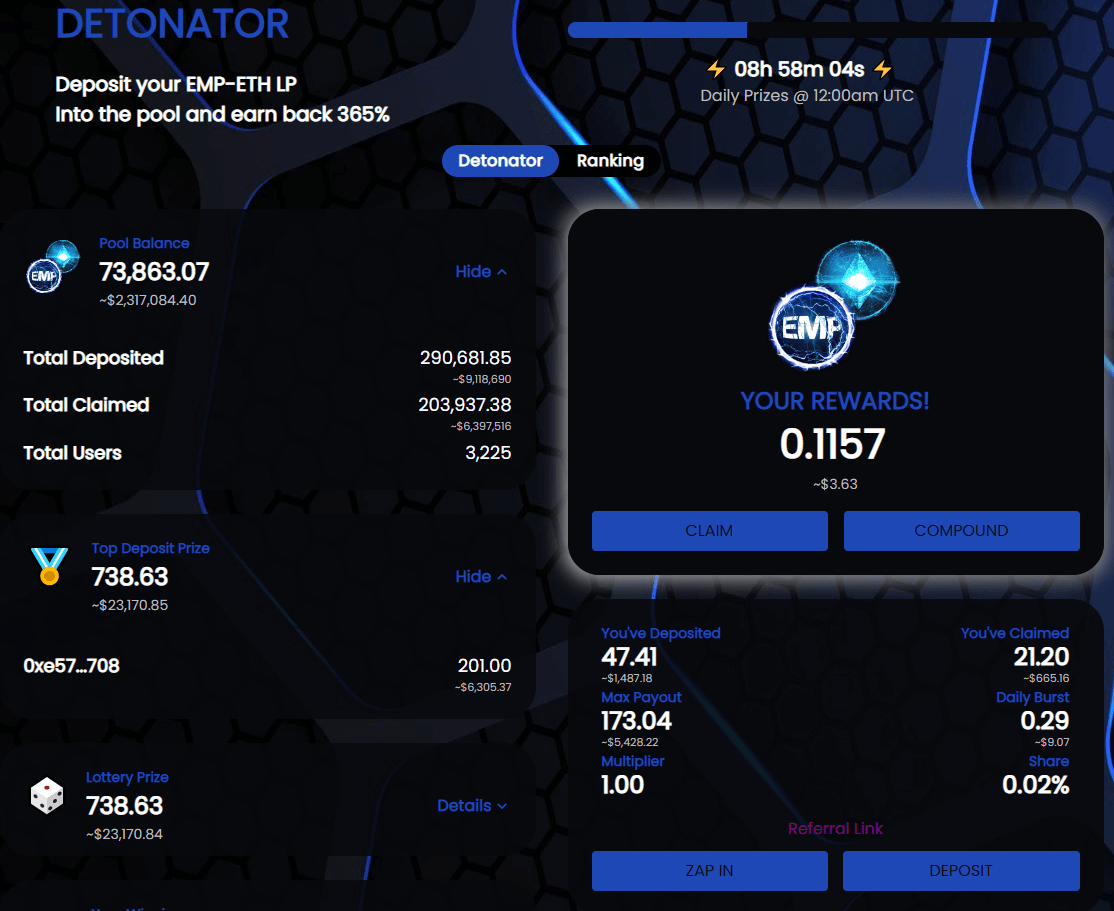

EMP Money Detonator is where the money is.

It’s a vault that gives you 365% of your initial deposit guaranteed. The dollar value may fluctuate depending on how well ETH is doing, but you’ll make back 365% of your deposit in Ethereum over a year.

The vault pays around 1% a day. The number is ever-changing, and the returns are in the range of 0.70-0.80% a day. It will continue to pay until you’ve reached 3.65x your initial.

You can withdraw your daily profits or compound your liquid asset to grow your account.

The Detonator is the best way to make a profit for early investors from the ecosystem as the most stable and the least risky. However, it works similarly to DRIP, and your original deposit is burnt.

In theory, you should make back your initial in just 100 days. The platform has been around for a while and has done very well during the bear market.

The daily top depositor and random depositor prizes are well over $20k, so you can win the lottery.

Let’s look at the pros and cons of Emp.money.

No, far from it. EMP Money is not a scam. In fact, it’s one of the most lucrative crypto platforms today.

The platform has been consistently generating yields for a while. The performance has been impressive even during the bear market when the market sentiment is not that great.

If you use the 365% vault, you can easily make back 3.65x your initial. If you have some cryptos sitting on the side, you can benefit from this crypto biz op.

If you’re looking for safe and stable returns and minimizing your risks, you should check out Yieldnodes.

The non-trading platform has been around for over three years and has performed exceedingly well in times of crisis.

You can find an in-depth review of Yield Nodes here.

Disclaimer: I’m not a financial advisor, and this is not financial advice. The content on this website is strictly for educational purposes only and should be treated as such. Investing is risky, and you should be prepared to lose your original investment if things go south. It’s best to consult a licensed financial advisor if you’re considering investing in an asset class.

Related Reviews

Last updated: September 1, 2023