Are you looking to learn more about Yieldnodes?

You’ve come to the right place.

In this complete Yieldnodes review, we examine the platform in greater depth and reveal everything you need to know before using it.

Earning a passive income has never been easier with cryptocurrencies. With the introduction of DEFI and yield farming, things have only improved.

Unlike most platforms, Yield Nodes are not involved in trading or other activities. Instead, it relies on what they call mastering.

Is YieldNodes a Ponzi scheme, or are they legit? Read on to find out.

Yieldnodes aims to generate profit with master nodes, which are considered blockchain networks ‘heart and soul.’ The platform creates and rents out servers for various projects (not limited to cryptos).

A master node is like a server that helps transactions go through. For every block that’s successful in the blockchain, the master node earns a fee/reward.

This continues to accrue over time, and the more the blockchain/nodes are used, the higher the monthly yields will be as more transactions are validated.

These nodes validate the transactions using the proof-of-stake mechanism, which is more environment-friendly than Bitcoin’s proof-of-work.

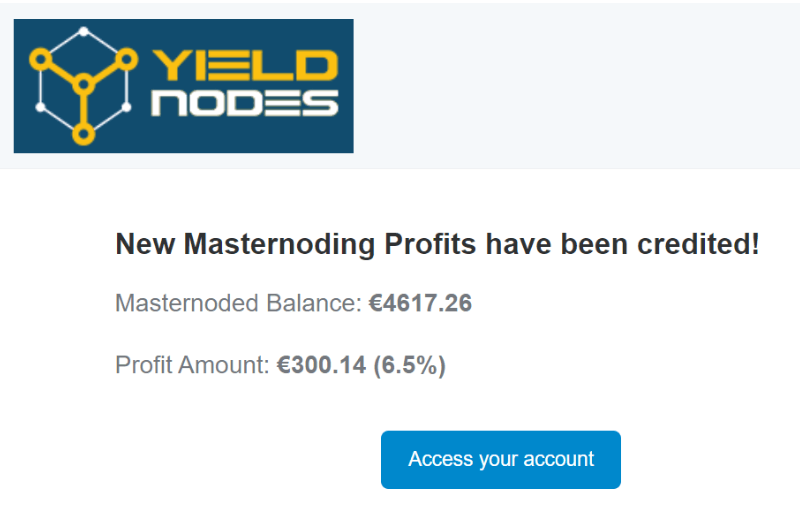

The popular node rental program reports monthly and shares the statistics inside the Yieldnodes dashboard. Their email newsletter does a good job of providing updates, recent developments, and news.

The company keeps a small share of the profits, separate from the monthly yields you’ll earn. The platform makes between 6 and 10 percent monthly yields, translating to nearly 100% yearly returns.

As a node validator, the more the network(s) are used, the more you earn.

As with all investment platforms, this does have some risks. Cryptocurrencies are a risky asset class; you must have a slightly high-risk tolerance.

Even though it’s a non-trading platform, losing your money is still risky. Before investing in any platform/project, you must consider the risk-reward ratio and do your due diligence.

You should also never invest more than what you can afford to lose.

In order to deposit Yieldnodes, you’ll need to have some Bitcoin or USDT (on the TRON network/chain) in your cryptocurrency wallet.

Bear in mind that the minimum deposit is 500 euros, not dollars. That’s the minimum they ask to set up a master node using your money.

If you are wondering, there’s no ongoing fee or price for depositing.

You can choose to deposit less if you want to, but the money will not be used to set up a master node until you meet the minimum threshold of 500 euros.

According to the website, the maximum is 250,000 euros, above which you’re suggested to contact support. You can still compound if your account grows beyond this figure, and you certainly can be a Yieldnodes millionaire!

Also, once you deposit, it will stay idle for seven days. As per Yieldnodes, this time is taken to set up new servers and get you up and running with the platform.

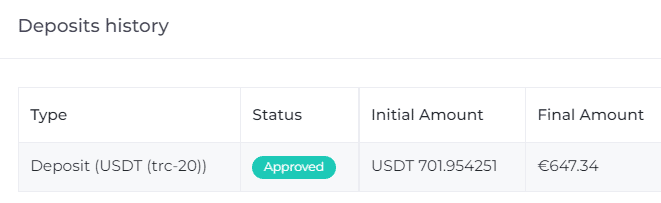

Once the waiting period elapses, your account balance will move from pending to master node state. To test the waters, my initial deposit was 701 dollars, which I paid with Tether (USDT).

Fast-forward to May. My initial deposits have grown over time, and the yields are as stable as they get—they range between 7 and 10 percent (per month).

You receive an email with your active master node balances and profits for the month on the 1st of every month.

This question comes naturally if you’ve just heard of the platform. That brings us to another question – How long will Yield Nodes last?

The node rental program has been going strong for over three years (as of this writing). It has survived the crypto bear market and has thrived.

The platform’s survival of the cryptocurrency bear market and the COVID-19 crash says a lot about it.

However, it’s still in your best interest to be skeptical. This is one reason I deposited only 701 dollars on my first try.

It’s worth noting that the initial contract is locked for six months (just like it would be in validator nodes), after which you’re free to cancel it anytime.

You can withdraw your profits anytime, but it is best to send a withdrawal request before the 15th of every month.

They take this time to dissolve master nodes and servers and aim to get you paid by the 8th of the next month. This has been the norm.

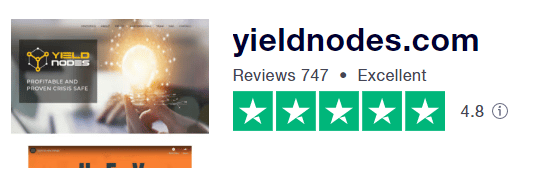

You’ll find nothing but praise if you check TrustPilot for Yieldnodes reviews.

The Yieldnodes calculator provides detailed stats. It tracks the platform’s performance over the last three years and compares it to Bitcoin, Dow Jones, and Gold.

User reviews and audit reports both speak highly of the platform.

As you can see, the platform has consistently generated high yields with masterminding, and an initial deposit of $2,000 would have grown exponentially with the power of compounding.

Before investing in anything, it’s best to consider the pros and cons. This will help you set the correct expectations before you begin.

Let’s take a look at the pros first.

Now, the cons. This Yieldnodes review will be incomplete without your awareness of the cons. Yieldnodes isn’t perfect—no program or platform is.

That brings us to the conclusion of this Yield Nodes review. The platform is definitely legit, and you certainly won’t find a Yieldnodes alternative.

It’s not even close to being considered a Ponzi or a pyramid scheme. It doesn’t have any of the characteristics of a scam. The team’s photos and LinkedIn profiles are visible, and everything they do is transparent.

When the best nodes for passive income with cryptocurrencies are mentioned, Yieldnodes definitely ranks high (close to the top).

There’s no tax involved (at least on the Yieldnodes’ side), and the monthly returns are quite stable. They range between 6% and 10% a month.

There’s nothing wrong with the platform apart from the withdrawals, which take close to a month. The platform, however, hasn’t faltered, and the withdrawal requests are always honored on time.

The platform highlights this in a warning, and that helps with trust.

It only makes sense since this is like setting up real servers. Dissolving them will take time because of the obvious work involved.

Despite all the cons, Yieldnodes is among the best alternative investment platforms. Setting up an account with them is free anyway, so it won’t hurt to sign up.

Disclaimer: I’m not a financial advisor; this is not financial advice. Everything I have mentioned in this article is my opinion and should be honored. If you want to invest anywhere, you should be aware of the risks and should factor in the risk-to-reward ratio. You should never invest more than you can afford to lose. It’s also best to consult a financial advisor before you begin.

Last updated: November 28, 2024